Applied Overhead and Actual Overhead – A Quick Guide for Manufacturers

Any manufacturing operation will inevitably incur overhead expenses – indirect costs associated with production. Calculating and adding these costs precisely per produced item is pretty much impossible. This is where applied overhead comes in. Let’s take a closer look at what is applied overhead, how it differs from actual overhead, and why it matters.

You can also listen to this article:

What is applied overhead?

Applied overhead is a fixed amount of cash added to a unit’s production cost in order to take into account the indirect costs of production. In more technical terms, applied overhead is the predetermined rate of indirect expenses associated with production that is allocated to a cost object, such as a product or a job. The bases for allocating applied overhead i.e. finding the rate of overhead per unit produced, are usually either direct machine hours or direct labor hours.

By and large, production incurs three main types of expenses – labor costs, material costs, and manufacturing overhead costs. Labor and material costs, also known as direct costs, are quite easy to calculate because they are directly measurable. Overheads, on the other hand, are indirect costs that are difficult or impossible to precisely allocate per produced unit.

Take, for example, a factory’s utility bill, machinery depreciation, lubricants, or cleaning supplies. These are basically impossible to accurately allocate to produced goods, yet they still contribute to product cost and therefore a company’s cost of goods manufactured (COGM), and need to be reconciled from a cost accounting perspective.

To solve this, manufacturing overheads are predetermined based on historical data and applied to manufacturing jobs at a fixed rate. Applied overhead is also known as the predetermined overhead rate, overhead absorption rate, or allocated factory overhead.

What is actual overhead?

Actual overhead denotes the real measured indirect costs that go into the production process. Since many indirect costs are difficult to gauge as production occurs, actual overhead is measured in retrospect, as opposed to the forward-looking estimating that is applied overhead. In other words, actual overhead is the tallied real-world costs gleaned from actual utility bills, the exact cost of cleaning supplies used, and so on.

Understanding actual overhead is crucial for two reasons.

- First, it helps in reconciling any variances between estimated and real costs. This is invaluable for future cost estimations because knowing your actual overhead enables fine-tuning applied overhead rates for future projects, aligning them more closely with reality.

- Second, it provides a foundation for more accurate financial statements, ensuring compliance and integrity in reporting. Unlike direct labor and material costs, actual overhead takes into account many minute costs that may be often overlooked in the production process. These can aid in forming a more comprehensive understanding of a product’s total manufacturing cost.

Read more about manufacturing overhead.

What is the applied manufacturing overhead formula?

For calculating applied overhead, three variables should first be determined. These are the allocation base, the predetermined overhead rate, and the planned number of cost units for the period.

- The allocation base usually consists of either direct machine hours, direct labor hours, or a combination. These denote the time that corresponding workstations spend on creating a product. The data on this activity can be gathered very accurately in modern manufacturing. For example, when a shop floor worker reports the start and finish of their operation to the manufacturing execution system installed by the company.

- The predetermined overhead rate calculation is quite straightforward. The actual overhead cost from previous periods or an accurate estimation of upcoming overheads is divided by the allocation base.

Predetermined overhead rate = estimated overhead / planned allocation base

- The planned number of cost units a.k.a planned production volume for the period can similarly be estimated or forecasted using historical data and effective production planning tools.

Once these variables are known, finding the applied overhead is as simple as multiplying the predetermined overhead rate by the direct labor hours that a cost unit takes to produce.

Applied overhead = predetermined overhead rate x allocation base per cost unit

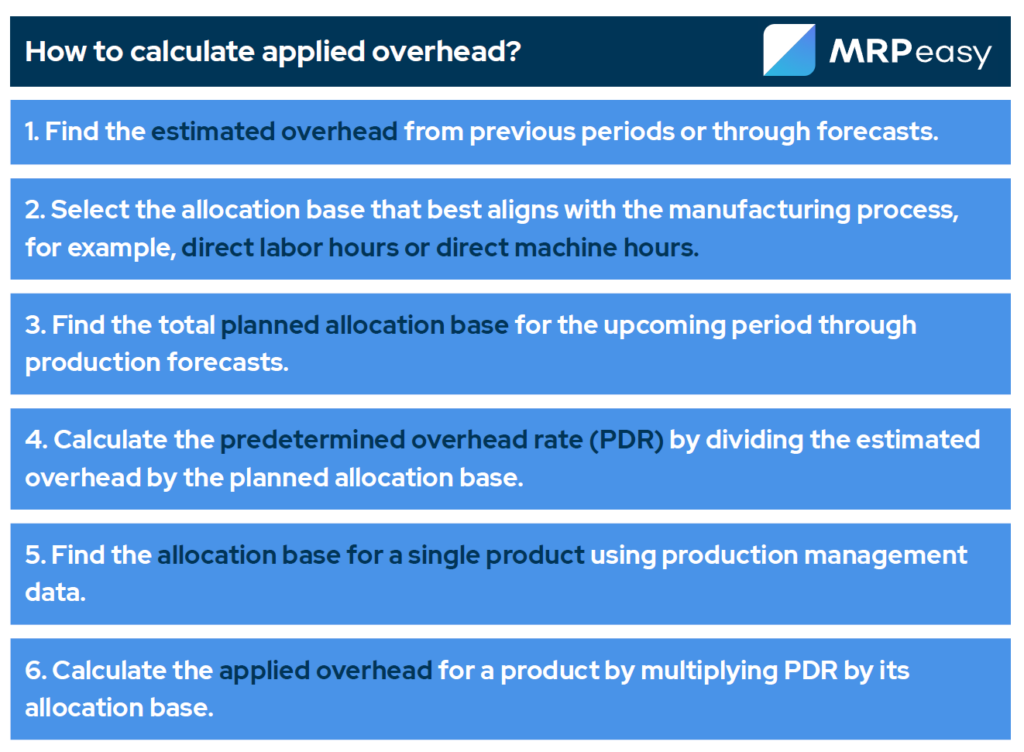

Here is a rundown of calculating applied overhead:

Example of applied overhead

Let’s go through an example to illustrate the above process.

Let’s say a company incurred $100,000 in overheads last period and forecasts the current period to have similar numbers. Meanwhile, the production volume forecasted for the period stands at 15,000 direct labor hours.

The predetermined overhead rate is therefore $100,000 divided by 15,000 which is $6.67 per direct labor hour.

Next, using production management software, the production manager determines that one product takes 250 direct labor hours to complete.

Therefore, the applied overhead per cost unit is 250 x $6.67 which equals $1,667.50

Reconciling over and underapplied overhead

No matter how well-run a manufacturing company is or how good its estimations are, applied overhead is still an estimation. At the end of the year or accounting period, the applied overhead will likely not conform precisely with the actual amount of overhead costs.

If too much overhead has been applied to jobs, it’s considered to have been overapplied. If too little has been applied, it is underapplied. Since the applied overhead is in the cost of goods sold (COGS) at the end of the accounting period, it has to be adjusted to reflect the actual costs. If a company has overapplied overhead, the difference between applied and actual must be subtracted from the cost of goods sold. And if they under-applied, it must be added.

The advantages of using applied overhead

Understanding and accurately calculating applied overhead is more than a bookkeeping exercise. It has real, tangible benefits that can make a difference in the profitability and operational efficiency of a manufacturing business. Here are some of the advantages:

- Enhanced cost predictability. A well-calculated predetermined overhead rate allows for better forecasting of the costs associated with producing a particular item. This simplifies setting prices that are both competitive and profitable.

- Informed decision-making. Applied overhead cost helps companies make better-informed decisions, particularly in the middle of the fiscal year. For example, it can give decision-makers a clearer picture of the financial ramifications of scaling up production, launching a new product, or investing in new machinery.

- Improved cost tracking and cash flow management. Being off the mark with overhead estimations can result in serious cash flow issues. Accurate applied overhead calculations help to more reliably predict how much money needs to be in the bank to keep operations running smoothly.

- Regulatory and compliance benefits. Accurate cost accounting isn’t simply good practice, it’s often also a legal requirement. Knowing the applied overhead can assist in meeting regulatory requirements and complying with accounting principles related to financial reporting or auditing.

- Performance reviews and incentives. A better understanding of cost structure allows for evaluating the efficiency and productivity of different departments and team members more accurately. This could form the basis of performance reviews or the distribution of incentives.

Understanding and accurately calculating applied overhead is an invaluable tool in the managerial toolbox. This applies both to manufacturing veterans as well as newcomers just setting up shop. While it’s just one piece of manufacturing accounting, it can significantly aid in helping the big picture come into a clearer focus.

Key takeaways

- Applied overhead refers to the estimated costs allocated to a product or job based on a predetermined overhead rate which is usually derived from historical data and future projections.

- Actual overhead refers to the real costs incurred during the production process. The comparison and analysis of these two types of overhead can provide valuable insights into production efficiency, cost management, and overall business performance.

- Applied overhead can be calculated by finding the predetermined overhead rate and multiplying it by the allocation base of a single cost unit – the number of direct labor hours or machine hours that go into manufacturing a finished product.

- Applied overhead is critically important for manufacturing accounting and product cost estimating. However, it’s also useful for enhancing cost predictability, cash flow management, achieving regulatory compliance, and more.

Frequently asked question

Actual overhead is the real, measured indirect costs associated with the production process, which are calculated after the fact. Applied overhead, on the other hand, is a predetermined rate of manufacturing overheads that is allocated to a cost unit, usually based on direct machine hours or direct labor hours.

To calculate applied overhead, you first determine the predetermined overhead rate by dividing the estimated total overhead costs by the planned allocation base (usually either direct machine hours or direct labor hours). The applied overhead is then calculated by multiplying the predetermined rate by the actual number of allocation base units used in the production process.

Underapplied overhead occurs when the actual overhead costs at the end of a financial period are greater than the applied overhead that was estimated. In this case, the difference needs to be added to the cost of goods sold (COGS).

Fixed overhead costs are constant expenses that do not vary with the level of production or sales, such as rent, salaries, and insurance. Variable overhead costs, however, fluctuate in direct proportion to changes in production volume. These are things like factory utilities, shipping materials, etc.

You might also like: What Is Job Costing and How To Do it?